The current state of the supply chain industry

In a December 2023 issue of DC Velocity, leading executives from Old Dominion, C.H. Robinson, and others indicated that a multitude of factors have contributed to decreases across the board for the entirety of the logistics industry. While not overly shocking, since the pandemic propelled supply chain services and operators to unforeseen heights, the adjustment isn’t as simple as the market returning to nominal levels.

While 2024 isn’t expected to be a slump – a few factors currently in play have led analysts and operators to believe it won’t be as profitable as previous years.

Negative factors influencing the supply chain

- Geopolitical issues straining overseas supply chains and the acquisition of materials. The most notable being tariffs and restrictions on Chinese imports and secondly – the conflicts in Europe and the Middle East

- Excess inventory due to low-consumer demand

- Decreased capacity and storage space due to that low demand

- Inflation increasing costs across the board, while also influencing consumer and partner behavior to turn to a more economical mindset

- Freight rates have bottomed significantly due to an excess of available truckloads and carriers that surfaced during the pandemic, along with the aforementioned low-demand for stock.

- Excessive consumer demand during the pandemic have left warehouses, DCs, and intermodal ocean shippers with surplus volume, leading to a significant reduction in shipping and import operations.

Positive factors influencing the supply chain

- Government focus on insulating supply chains, especially rail – to avoid repeats of the strains encountered in years prior.

- Federal debt increases to spending to avoid a full-blown recession have held steady, along with strong consumer purchasing despite economic headwinds have stalled a full-blown recession. While not out of the woods, the outlook is better than it was a year prior.

- Adjustment of warehouse and distribution center construction and increased vacancy has opened up the real estate market for operators looking to expand into new spaces.

- With the decrease in demand (especially in trucking), layoffs from key players in the industry are inevitable. In turn, this will open up a much larger candidate pool for operators that are still experiencing labor issues.

- Many operators are shifting material providers from overseas to manufacturers closer to home. For example, Mexico has usurped China in import profits. As of July 2023, Mexico made up 15% of US imports, while China made up 14.6% – indicating a significant portion of supply chains are shifting their suppliers away from distant countries.

- Material handling automation integrators typically follow the effects of the supply chain by a year. Larger corporations have already or are currently implementing automation, opening availability for smaller companies looking to implement a system.

Recession scares

Despite predictions of an impending recession by economists, the resilience of the supply chain industry has defied these forecasts, primarily due to the sustained momentum in consumer spending. This unexpected endurance in consumer activity has, to a considerable extent, delayed what many experts once deemed an inevitable economic downturn.

While the supply chain industry has demonstrated robustness in navigating challenging economic landscapes, it would be prudent for smaller operators within this dynamic ecosystem to adopt a proactive approach. Investing in preventative maintenance for their conveyor equipment emerges as a strategic imperative. This forward-looking strategy not only ensures the continued operational efficiency of critical material handling systems but also serves as a safeguard against potentially exorbitant expenditures in the future when financial resources may be constrained. By prioritizing preventative maintenance, these operators are not merely reacting to the current economic climate; rather, they are strategically fortifying their infrastructure to weather potential storms and position themselves for sustained success in a fluctuating economic landscape.

Automation adaption continues growth

In a recent survey by Modern Materials Handling about material handling systems currently installed and in use at DCs, survey participants reported the following:

The use of autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) shot up to 20% in 2023, from 7% last year, while use of robotic arms/work cells reached 23%, up from 10%.

In terms of other systems in use, deployment of conveyors reached 41% this year, up from 31%; while use of vertical lift modules grew from 25% last year to 34% this year. Use of shuttles reached 13%, up from 4%.

While the notion that automation continues to be implemented is unsurprising, the rate at which is rapid. Supply chain technology continues to advance, ushering in countless new systems and equipment all while removing cost-prohibitive and accessibility barriers. Explosive growth across all MHE systems brings credence to the effectiveness of automation, with the variable being how it is implemented rather than the performance of the equipment itself.

Warehousing employment

Unemployment rates in transportation and warehousing increased from 3.3% in October 2022 to 4.5% in October of this year, reported by the Bureau of Labor Statistics. This indicates that finding labor for distribution centers and warehouses is still an ongoing issue. No doubt the hassle of finding associates correlates to the ongoing deployment of automation to eliminate the need for manual laborers.

As mentioned before, many companies are experiencing the end of drastic growth spurred by the pandemic – leading to large layoffs at companies that hired extensively to account for the growth in past years. In turn, this should open up the candidate pool for employers still struggling to fill warehouse associate roles.

Alternatively, gradually replacing manual labor with automation has traditionally been the most optimal way of adapting to demand fluctutations. Implementing a new system from scratch isn’t always feasible, but a proper retrofit or taking automation one step at a time can make reaching those KPIs just a bit easier while keeping costs down.

Lean and mean

Many warehouse and distribution center operators took the lessons learned from the supply chain disruptions to heart, opting to implement leaner strategies and eliminate situations in which waste or inefficiency exists. The burning issue in warehousing currently is capacity and inventory levels. Dwindling demand has left some warehouses brimming with slow-moving or unsold stock, leading many to cancel orders and shed excess weight.

“The broad measure of inventories to sales ratio across U.S. retailers has stood at 1.30 from May 2023 through October, suggesting merchants have achieved some stability after the roller-coaster pandemic years.” (WSJ)

This flip signifies that shippers are not hoarding product to capitalize on sales, but stabilizing levels so inventory doesn’t become stagnant. As reported by The Logistics Manager’s Index, U.S. operators drove levels down 13 points from a year ago.

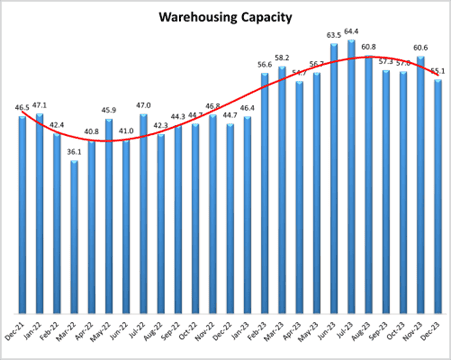

Naturally, capacity is up from 2022 Q4 as well, 10.4 points – a significant but not shocking decrease, even adjusting for the peak holiday season.

Warehouse and DC real estate

The warehouse real estate market has cooled down significantly after the rush the pandemic created, but leasing, rents, and construction of new facilities continue at a steady pace. Current vacancy in New Jersey hovers around 3.8%, a rise from last year but still overall low. Many operators are taking a “wait-and-see” approach before investing in properties for 2024.

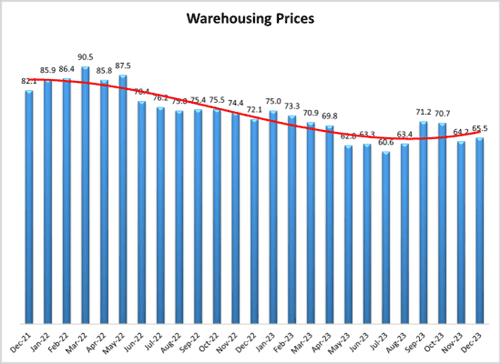

Prices have dropped dramatically from their peak nearly within two years at an index number of 90.5 in March of 2022 to 65.5 in December of 2023.

While mileage may vary depending on the location and specifics of the facility, prices are overall lower. This makes acquiring space more economically accessible for smaller operators looking to expand but have not yet pulled the trigger. Larger corporations like Amazon, Walmart, and Home Depot have mostly halted snapping up new warehouse space, freeing up commercial real estate inventory and increasing vacancy rates.

Summary

The name of the game for distribution centers and warehouses in 2024 is equalization. The explosion of pandemic-era demand is over, and valuable lessons about the importance of the integrity of the supply chain have no doubt influenced change across the industry.

Unpredictable consumer behavior, economic uncertainty, material shortages, geopolitical conflicts, and capacity issues – to name a few – are all factors that have impacted the industry in one way or another. Operators of warehouses and distribution centers would be wise to recognize the prevailing headwinds their organizations encountered and use 2024 to bolster themselves against those barriers – and any others in the future.

Whether that’s pairing down inventory to just-in-time levels, automating material handling procedures, expanding into new commercial space, or completely overhauling logistics processes – 2024 is the year to do it.

Equalize, adjust, and point your DC or warehouse in the right direction for success.