Automation: the only way forward.

Warehouse and distribution center operators are under more pressure in 2026 than at any point in recent times. Volumes continue to climb, labor remains unpredictable, and viable space is both expensive and limited to come by. At the same time, customer expectations for speed, accuracy, and consistency haven’t softened.

As a result, more companies are making a strategic shift toward material handling automation, not as a future initiative, but as a near-term necessity.

With how tariffs and geopolitical winds shift so drastically in recent years, automation is a constant foundational system that can adjust accordingly to any low/high demand forecasts and unseen barriers

Below are the top reasons automation is accelerating across warehouses and DCs, backed by real operational data and what we’re seeing in the field.

What is driving warehouse operators to automate?

Too Much Labor Is Spent Moving, Not Working

One of the most eye-opening statistics for warehouse operators is how labor time is actually used day to day.

On average, 40–60% of warehouse labor time is spent walking or transporting product, not picking, packing, or performing value-added tasks (TGW).

That inefficiency compounds quickly:

- More headcount is required to move the same volume

- Travel paths grow longer as operations scale

- Productivity gains hit a ceiling, even with good labor management and a large team

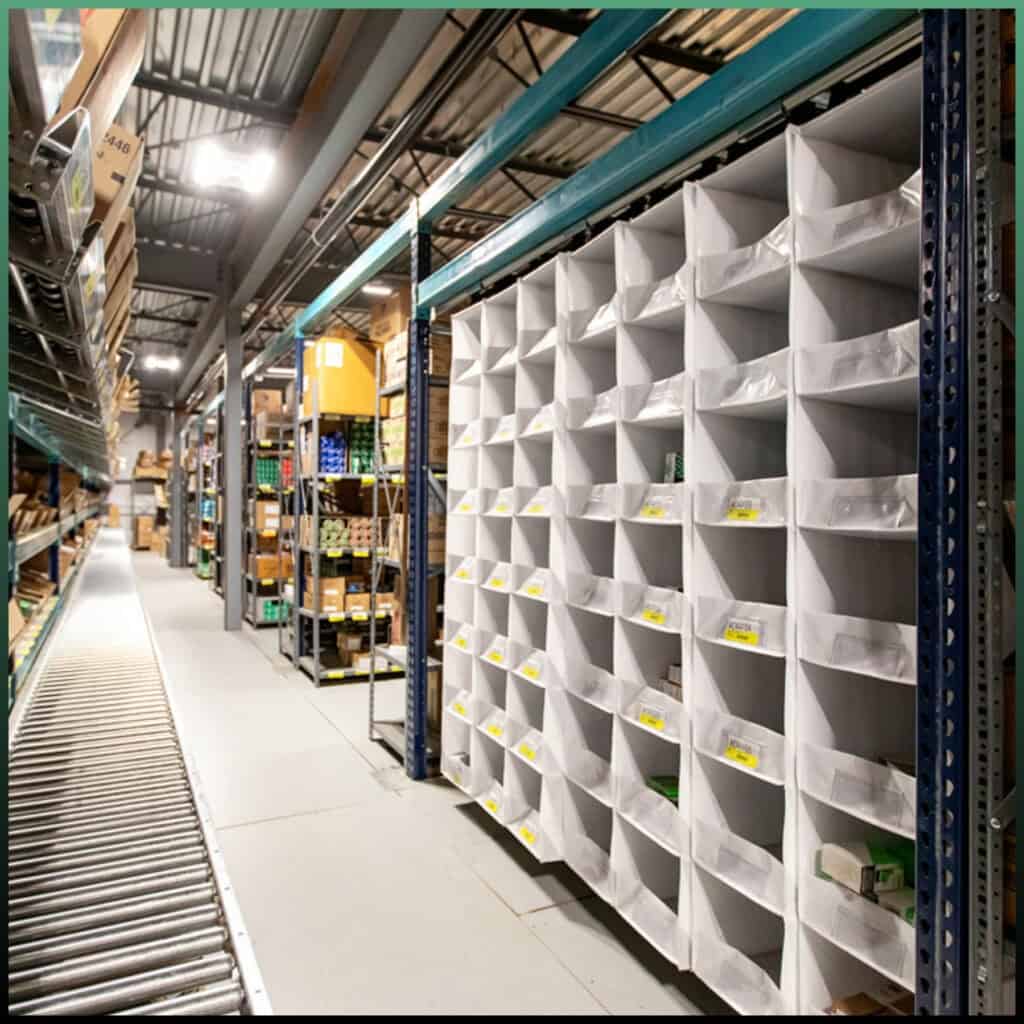

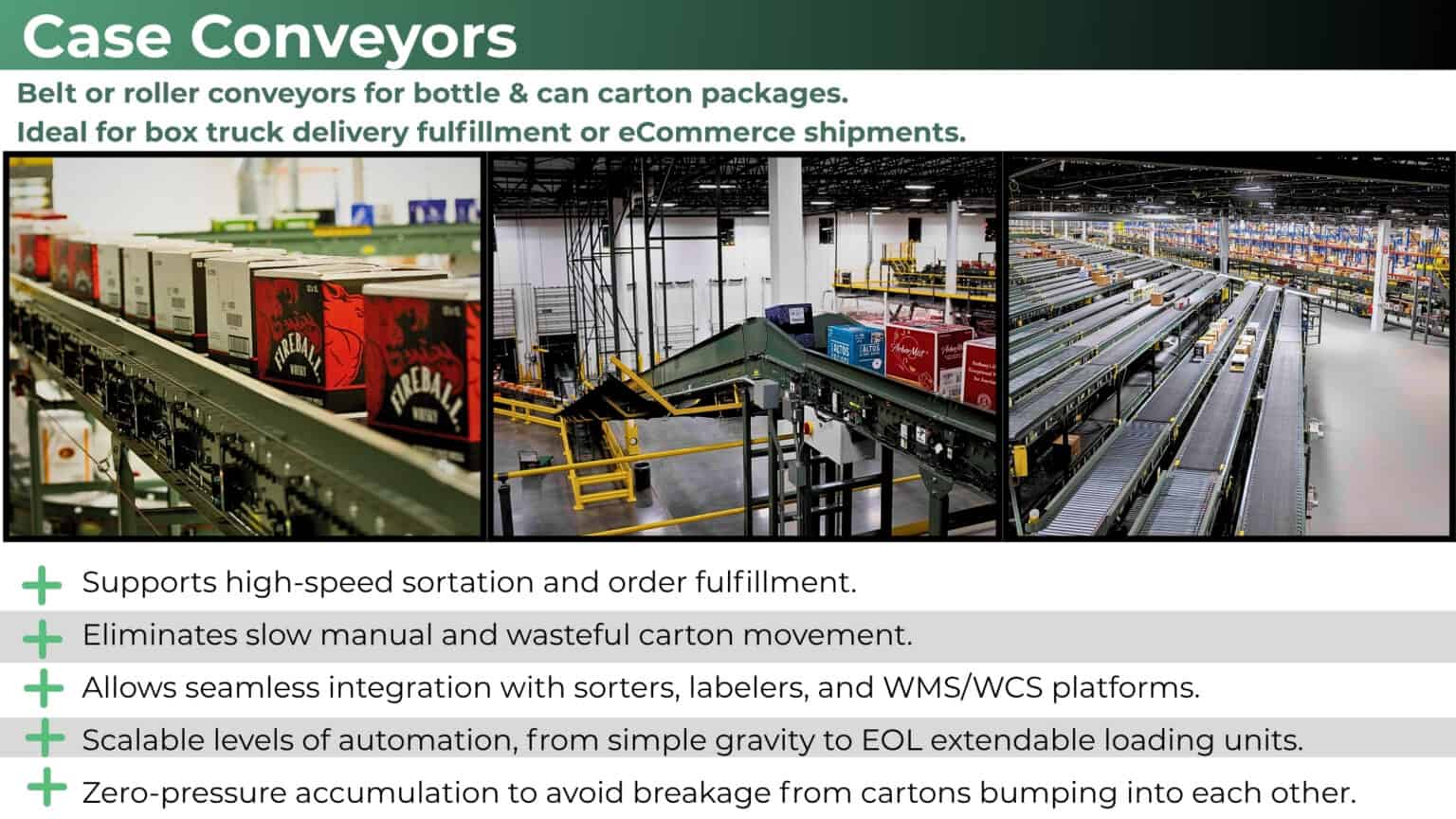

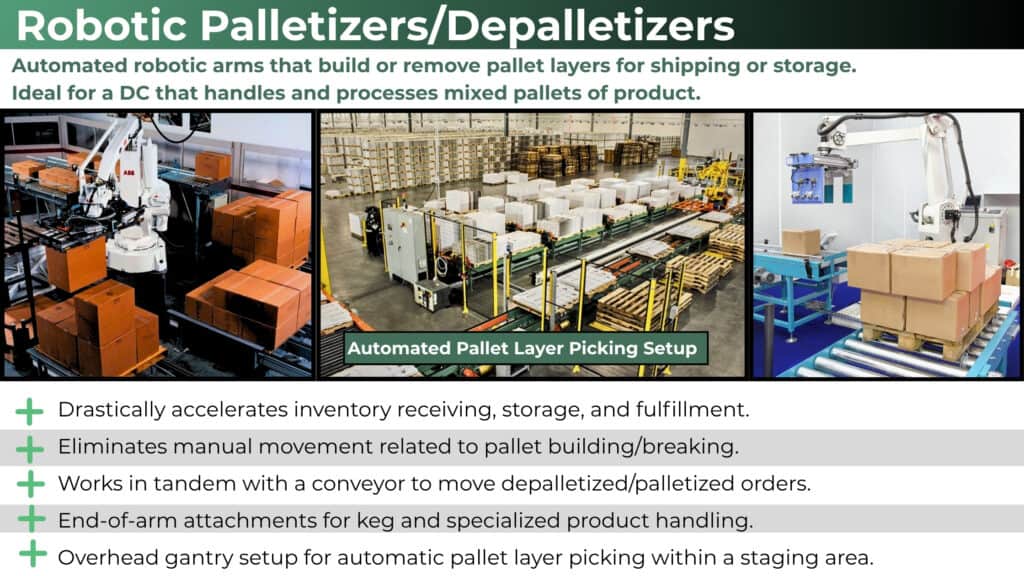

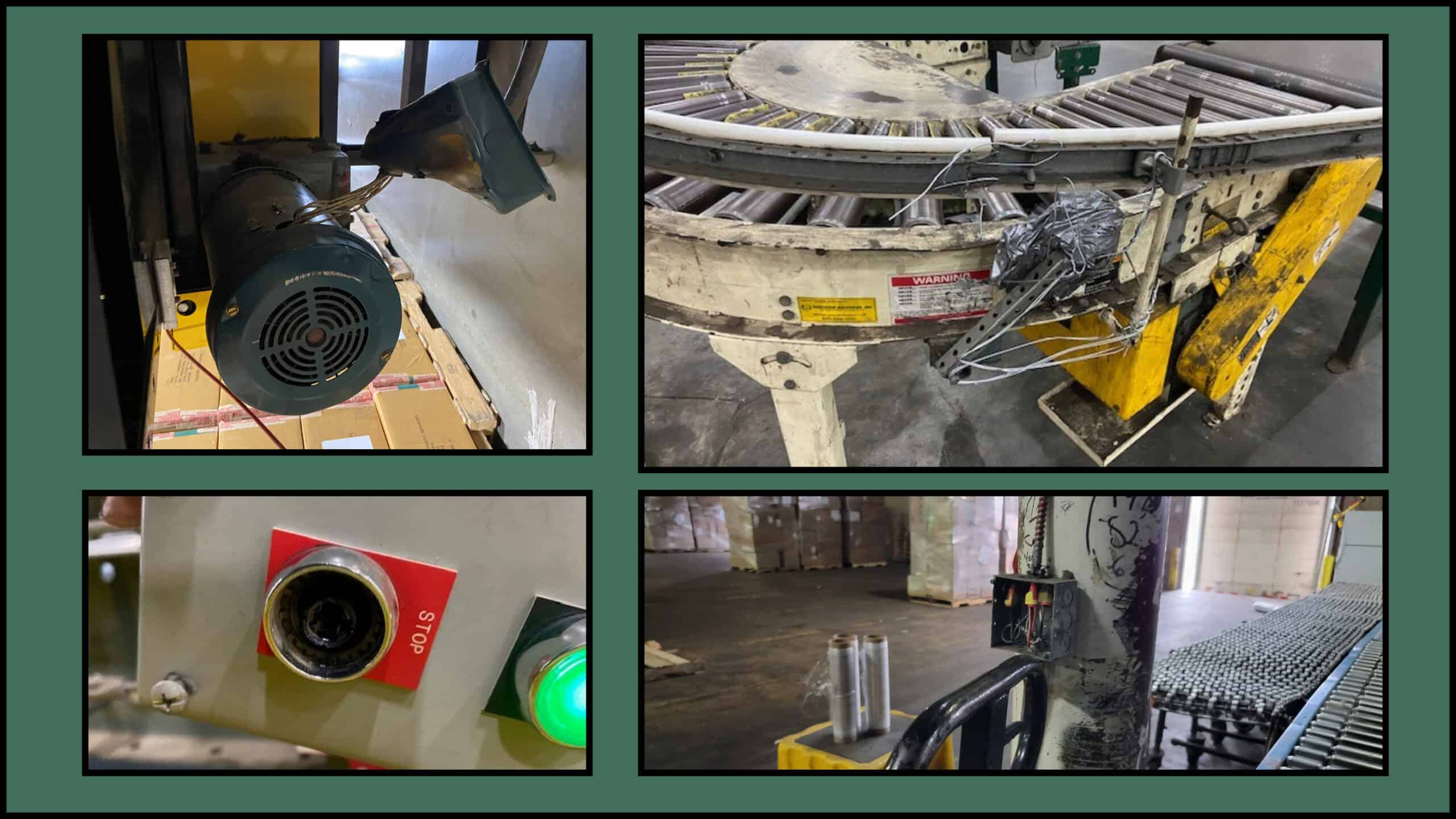

Conveyor systems, accumulation, and automated transport remove unnecessary travel from the equation. Instead of workers chasing product, product flows to workers, freeing labor to focus on accuracy, throughput, and exceptions.

Labor Availability Remains a Persistent Constraint

Despite wage increases and recruitment efforts, more than half of warehouse operators still report difficulty hiring and retaining quality labor (SDCEXEC). This has been an ongoing issue since COVID, and warehouses can’t seem to shake it.

- 42% of operators plan to increase use of flexible workers this year

- Certain warehouses report close to a 200% turnover rate (InboundLogistics)

- 52% cite finding reliable, quality labor as their top challenge

- Entry-level warehouse workers now earn between $19-$22 an hour in nearly half of facilities.

Automation doesn’t eliminate labor, it empowers workers to focus on more meaningful tasks while forgoing repetitive, monotonous work. Fewer workers are needed to move the same volume, training time is reduced, and productivity becomes less dependent on individual experience levels.

For many operators, automation is seen as the one true solution to removing significant staffing issues. If your company is growing, more employees will be required, which will only make hiring more difficult – unless automation can fill those gaps

Demand Is Growing Faster Than Available Space

A Prologis study finds that U.S. warehouse utilization is climbing toward expansionary levels, meaning companies are using up existing space and leasing more (Prologis). This often pushes operators to adopt automation to extract more productivity from existing facilities before expanding physical footprint.

With space at a premium both within facilities and in the market, operators are:

- Expanding into new building or investing in additions

- Overhauling a current setup to one that’s focused on maximizing space

- Increasing throughput density inside current facilities

- Re-evaluate warehouse network and consolidate facilities to a more automated site

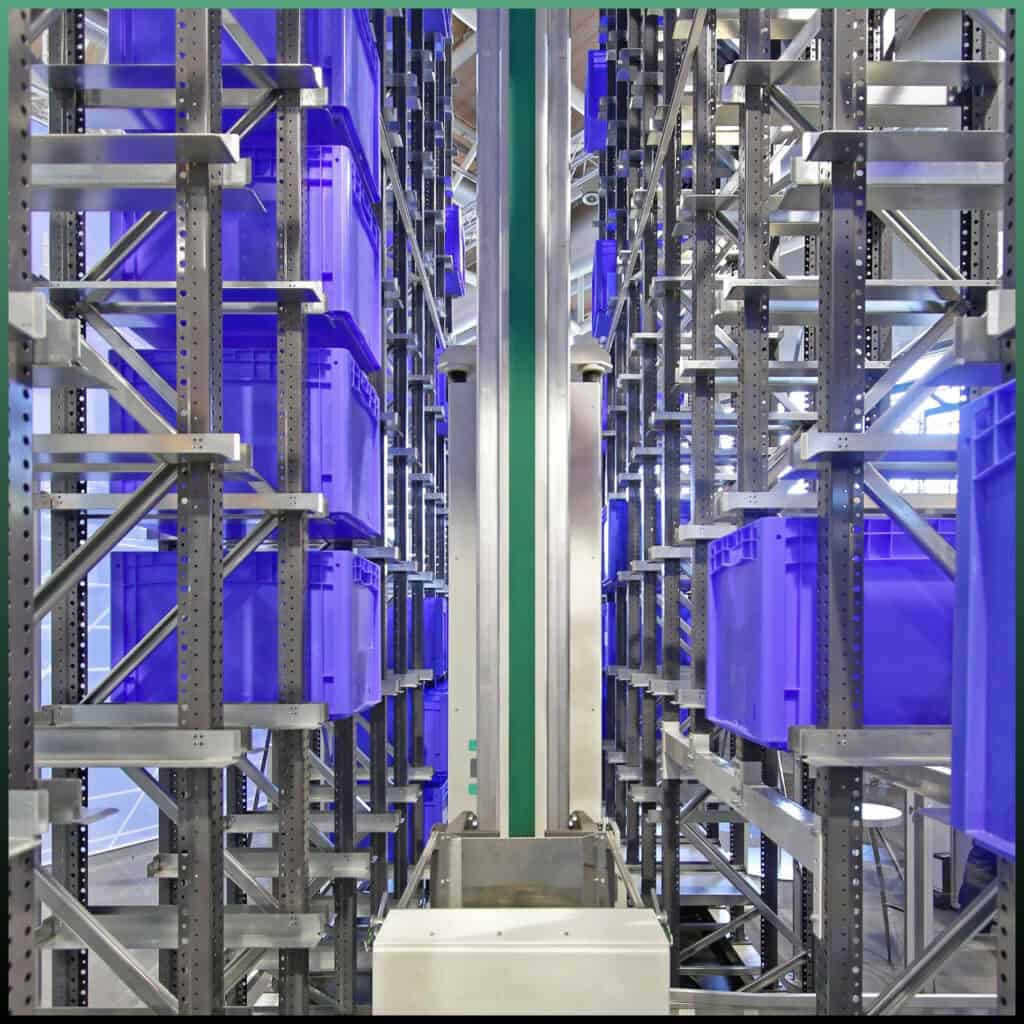

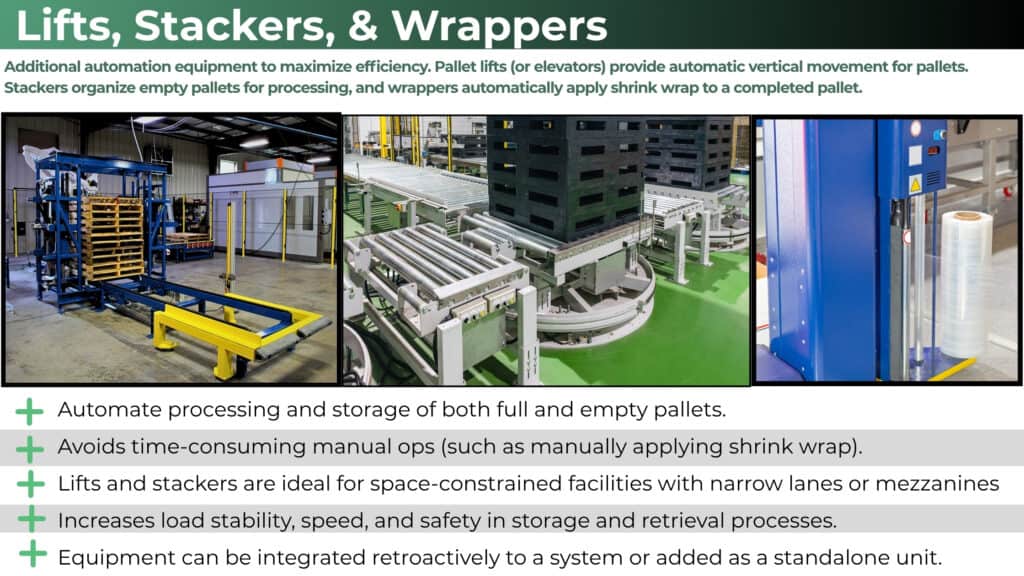

Material handling automation allows facilities to do more within the same footprint. Conveyors, sortation, optimal storage setups and vertical accumulation maximize cubic space, compress travel distances, and support higher order volumes without adding square footage. Second level mezzanines, ceiling-supported racking, and hanging conveyor lines can make use of vertical space while keeping warehouse floors clear

There exist many solutions focused on saving space, the hard part is selecting the best one for your facility and operational needs (This is something Century specializes in)

In short: automation enables growth when real estate cannot.

The Automation Market Continues to Grow

Just a few years ago, conveyor systems, robotics, sorters, and other automated equipment were considered “advanced” solutions reserved for large warehouse network operators (Amazon, Walmart, Home Depot).

That’s no longer the case.

The warehouse automation market size is estimated at $29.91 billion in 2025 and is projected to advance to $63.36 billion by 2030, reflecting a robust 16.20% CAGR. Growth rides on three converging currents: sustained e-commerce volume, persistent labor scarcity, and subscription-based robotics services that lower capital barriers. Hardware, particularly AS/RS installations and conveyor infrastructure, still accounts for most spending, yet software layers that synchronize people, robots, and inventory are scaling faster as fulfillment centers move toward data-driven orchestration. (Mordor Intelligence)

- By component, hardware captured 58% of the warehouse automation market share in 2024, whereas software is set to post the highest 17% CAGR through 2030.

- By technology, AS/RS led with 30.5% of warehouse automation market share in 2024; mobile robots are forecast to expand at a 20.5% CAGR to 2030.

- By end-user industry, retail & e-commerce held 28% revenue share in 2024, while e-grocery is projected to grow at 18.3% CAGR through 2030.

- By warehouse size, medium facilities (50–200 k sq ft) commanded 37% of the warehouse automation market size in 2024; mega sites (>500 k sq ft) are advancing at a 17.2% CAGR to 2030.

- By ownership, company-owned sites represented 52% of the 2024 warehouse automation market size, but 3PL facilities are expected to record a 16.4% CAGR to 2030.

This shift reflects:

- Lower barriers to entry

- Modular, scalable system designs

- Proven performance across industries

- Faster and more flexible implementation timelines

- The constant need to automate to capture increased demand

Automation is no longer a differentiator, it’s the baseline for competitive distribution operations.

ROI Timelines Are Shorter Than Many Expect

One of the most common misconceptions about automation is that it requires long, uncertain payback periods. The initial cost of a conveyor system might be eyewatering to some since the cost-effectiveness of the solution pays itself back in efficiency and time saved through other operational tasks rather than a direct correlated metric to total revenue.

In reality, the ROI on a conveyor system typically hovers around the 2-year mark, driven by:

- Reduced labor requirements

- Higher throughput with existing staff

- Lower error rates and rework

- Improved uptime and consistency

- The ability to serve more clients and take on more orders

For operations facing rising labor costs and capacity constraints, automation often pays for itself faster than incremental staffing or facility expansion.

Automation Supports Long-Term Flexibility

Modern material handling systems are designed with change in mind. Scalable layouts, zoned control, and adaptable software allow systems to evolve alongside:

- SKU growth

- New order profiles

- Channel expansion

- Facility consolidation

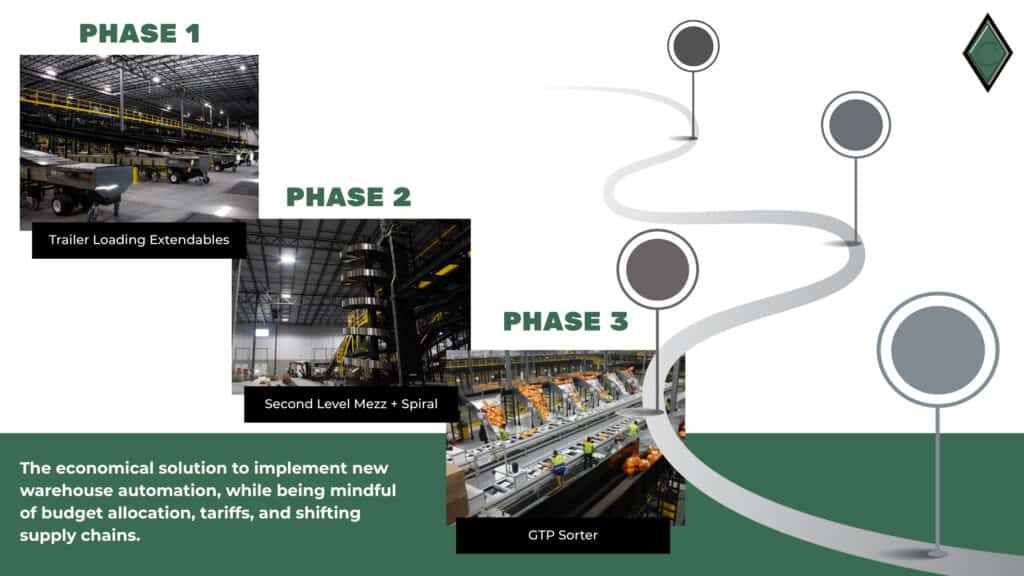

Century sometimes proposes a phased approach to integration for certain clients. Whether it’s because of budget, space, or a future process that requires additional planning – splitting a project into distinct phases can turn a large integration into manageable chunks.

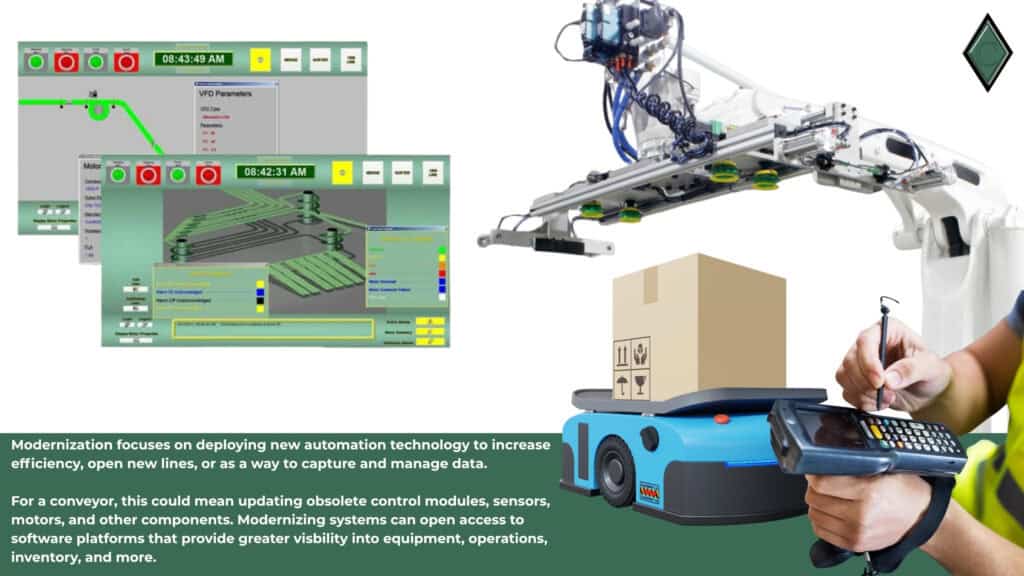

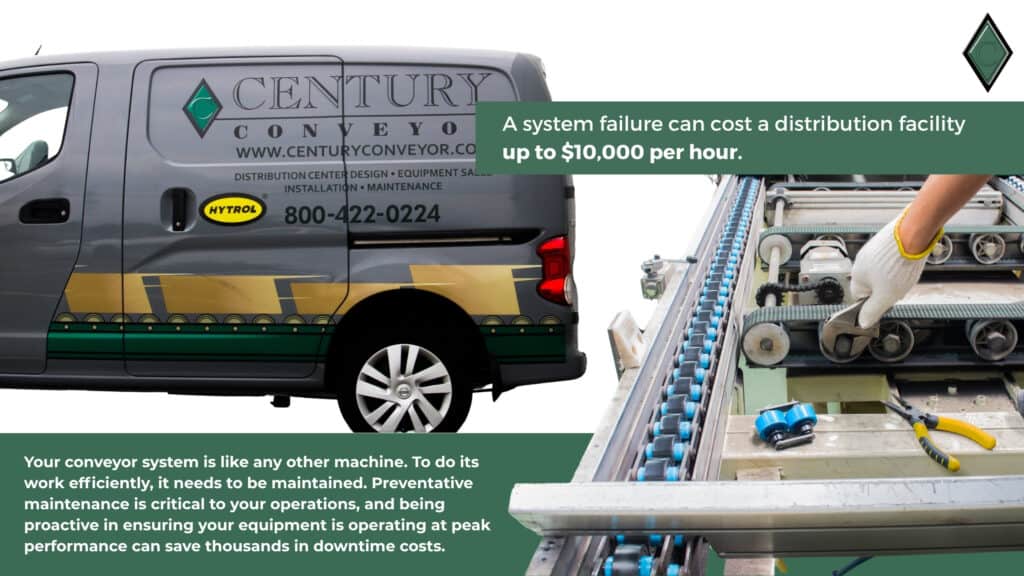

For a facility that already has an older system, but would like to upgrade, retrofits and modernization are two more methods Century has in the toolbox to breathe new life into an outdated setup.

Rather than solving only today’s problem, automation creates a foundation that supports future growth, without forcing constant redesigns.

Automation as a Strategic Advantage

The decision to automate is no longer driven solely by growth, it’s driven by resilience.

Companies investing in material handling automation are positioning themselves to:

- Do more with fewer resources

- Manage inventory in a visible and efficient manner

- Absorb demand spikes without disruption

- Enable data-collection for accurate system and order reporting

- Maintain service levels despite labor volatility

- Scale intelligently as business evolves

As 2026 unfolds, the question many operators are asking has shifted from “Should we automate?” to “How soon can we?”

How can Century automate my food distribution operation?

- Industry-specific expertise: Our specialization lies in high-speed fulfillment and distribution systems.

- End-to-end solution: Mechanical design, controls, integration, software and installation and service support under one roof. Selecting a turnkey A-to-Z integrator like Century can avoid an overly-complicated system implementation in which equipment doesn’t work in tandem, but in a silo (a Frankenstein, we like to call them).

- Scalable & modular design: We build for your current throughput and product handled but engineer dynamic variances for SKU growth, product type & size, seasonal peaks or future lines.

- ROI-driven: Given tight margins in distribution, our focus is on labor reduction, error minimization, space optimization, waste elimination and equipment selection that fits your budget and goals.

Century focuses on building the most optimal system, not the most expensive.

Contact Century

Will 2026 be the year you enable automation in your warehouse or DC?

If your facility is encountering any of the above issues, a proper material handling system can solve your top painpoints.

Century’s team of automation experts, engineers, and project managers will lend their extensive knowledge and skillset to help you and your organization in paving the way to a truly optimal automated distribution facility.