Increased adaption of automation

Much like last year, and the year before, distribution centers are continuing to integrate and enable various forms of automation. While the pertinent supply chain issues from 2021 and early 2022 have waned slightly, they certainly still exist, and distribution facilities are looking to ensure a similar event can be avoided or curtailed in the future.

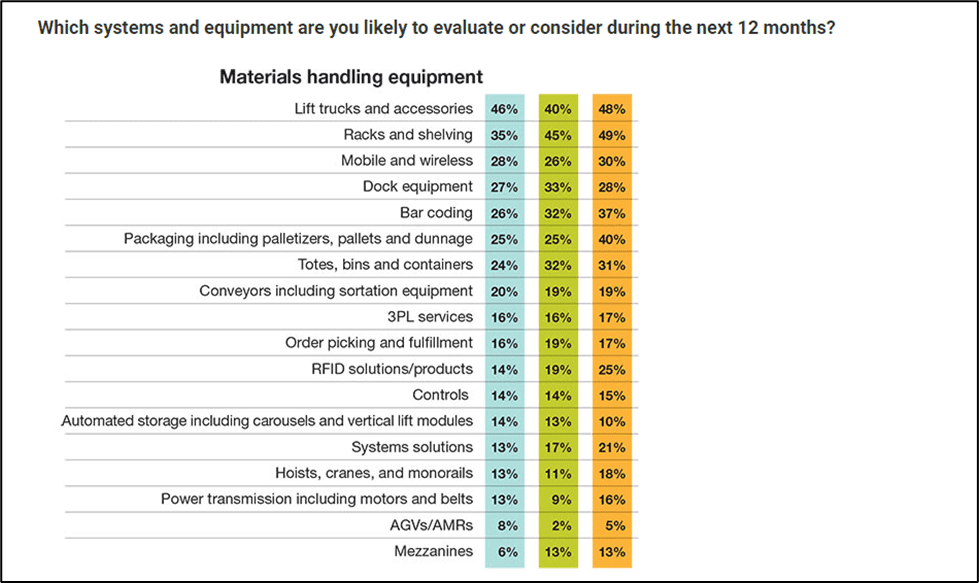

The 2022 Annual Warehouse and Distribution Center (DC) Equipment Survey documented by Peerless Research Group reports growing interest in material handling solutions and automation from 2020, 2021, and 2022.

The majority of systems have seen an increase over the past few years, and in 2022 alone, the leaders with the largest percent difference are packaging systems like palletizers, pallets and dunnage, from 25% to 40%. This can be attributed to the inexpensive (relative to other solutions) nature of packaging systems, the ease of integration as a stand-alone system, and how it eliminates drastically slower manual operations.

Distribution centers and warehouses (especially up-and-coming organizations) may choose to implement automation piecemeal. It could be too costly to automate all at once, or the required shutdown of operations may be out of the question for high throughput facilities. From the same study, 35% of respondents reported that eCommerce shipping (buy online, ship to customer from DC) accounts for the majority of their operations, while another 11% (up to almost half of the survey takers) say that eCommerce shipping will be the most common.

From the effects of the pandemic, supply chain strain, rising costs, customer behavior, and the difficulty in finding (and keeping) warehouse laborers, many companies are eager to implement at least SOME form of automation. The leading factor of offering quick picking, packing, sorting, and shipping for online purchases seems to be a driving force for automation, as it’s predicted eCommerce is only going to grow in the coming years. If the pandemic taught the supply chain anything, it’s to be prepared, and many distribution centers are taking that to heart by building up on automation now instead of when it’s desperately needed.

Neighborhood distribution centers and micro-fulfillment

Warehouse real estate space vacancies continue to dip as more and more distribution centers are being snatched up. As of Q1 of this year, a paltry 4.2% vacancy rate in the US is the current situation. Along with the low available space, rent in port locations has increased exponentially, with our hometown location in northern New Jersey seeing a 16.1% jump (DCVelocity).

The state of the market has led many companies to invest in innovative real estate solutions. Aside from adding additions or upgrading existing space with new systems, micro-fulfillment centers and “neighborhood DCs” have provided a viable alternative. Instead of purchasing or renting massive hub distribution centers, the focus has turned to smaller spaces that have the ability to be developed as local, spoke fulfillment centers.

This direction isn’t without its hurdles though. Certain prospective spaces are not zoned appropriately or are not in an area that an influx of trucks can support. Even if it meets all the necessary developing criteria, the local government may oppose a warehouse opening in a residential area. For example, New Jersey recently approved guidelines after objections were raised by municipalities about warehouses setting up shop in suburban and rural areas.

Only time will tell if these smaller DCs will continue to crop up, but it’s a creative solution to an arguably important aspect of the supply chain. Now-empty office and retail buildings (an effect of COVID) are a viable space for these mini-warehouses and can serve the local areas effectively if the operator can appropriately coexist with residents. Even existing spaces that operated as retail outlets for in-store shopping are dipping their toes in integrating micro fulfillment to serve buy online, pickup in store processes, as well as last mile delivery.

Are these pint-sized distribution centers the future? Large distribution centers are still being constructed, but outside of low-vacancy metropolitan centers. All the signs point to yes, as eCommerce perpetuates every purchasing channel, and efficient technology continues to offer solutions to most barriers.

Electric and autonomous last-mile delivery vehicles

The fastest growing example of small-scale solutions has to be the explosion in electric last-mile delivery vehicles. A major concern of opening the aforementioned mini-DCs is the traffic, noise, and pollution a 53ft trailer (and even box trucks) bring to a local area. In many instances, the road system is simply not designed to handle vehicles of that size.

The solution? A fleet of electric vans and small trucks that can service the nearby area. A considerably smaller carbon footprint, minimal change to local traffic, and the ability to navigate the majority of side streets and communities.

The leader in the industry– Amazon, has already begun rolling out its own fleet of electric vans and is planning to implement them in over 100,000 cities in the U.S. by 2030. If history is anything to go by, the rest of the industry will follow shortly after, if not already.

Of course, owning and maintaining a fleet of electric vehicles is not a viable option for many distribution centers. Alternatively, the amount of last mile transportation providers offering scalable EV solutions has exploded recently, with a plethora of companies to partner with, some of which include:

Along with the electric delivery vehicle startups, traditional automakers have also begun developing electric versions of their fleet and truck lineups. Expect more electric delivery vehicles to appear as the auto industry shifts to EVs.

Further down the line, but not too far off in the future, autonomous delivery vehicles are certainly a possibility. Tesla and Volvo have been spearheading technology in recent years testing autonomous trucks in a multitude of road challenges. The technology is there, but to be considered “fully-autonomous” might be a few good years out. The larger idea of autonomous trucks is the enablement of real-time data, continuous movement, and a focus on sustainability (all aspects of industry 4.0). Expect to see further development in autonomous vehicles throughout 2023.

Autonomous lift and reach trucks

Autonomous systems in the form of AGVs and AMRs have long existed in the material handling industry, but their uses are limited to specific situations, and typically are deployed in conjunction with picking operations. ASRS systems, those that pick inside a modular pallet rack, are another semi-autonomous system that has been integrated frequently, but the nature of its structure and operation leave it as a costly option typically reserved for very high throughput (same with shuttle systems like the Autostore). It seems like nothing can beat a simple forklift – until now.

Autonomous lift and reach trucks have been an idea in the hopper for a few years, but it wasn’t until DHL implemented them in one of their distribution centers that the technology was finally tested in a real-world environment. Essentially, there’s a bit of developing that has to happen to see these systems widespread, but it’s a quickly advancing segment that will most likely see great strides in improvement in 2023. Currently, the lift and reach trucks tested at the DHL facility came in slower than typical human-operated vehicles, and needed a team of engineers to run properly and fix errors. Relegated only to slow-moving SKUs in a monitored test area, the practice environment helped display any shortcomings the systems had, and once those issues were remedied, the lift trucks succeeded at completing the job they were designed to do.

As technology advances and trickles down from the major industry players, the idea of having autonomous lift and reach trucks is revolutionary. Most, if not all, distribution centers and warehouses have at least a few lift trucks. The best argument against using any form of automation (conveyor, ASRS, AGV, etc.) is that a lift truck is cheaper and can do it faster, depending on the environment it’s deployed in. With an autonomous lift truck, it’s a fusion from the best of both worlds. Keep the mobility and quickness of a lift truck, while benefiting from the stability and ROI-friendly use of automation.

AI solutions and machine learning (connecting disparate data)

As technology advances, the idea of industry 4.0 inches closer and closer to becoming a reality. The main driving factor is enabling the ability of automated systems to communicate and share information with each other. Seemingly disparate sources can connect and make decisions based on learned data, subsequent of human interaction.

With the sheer amount of both automated hardware and software available, being able to connect each resource AND having the systems take the most efficient decision represents a truly automated experience. This especially helps when considering companies that operate both manufacturing and distribution processes. Equashield, a medical device manufacturer, recently integrated their own proprietary AI and machine learning system and overcame obstacles related to manufacturing bottlenecks affecting fulfillment times:

“Along with our twelve-month stockpile of raw materials and highly efficient automated manufacturing line, we were able to overcome the backlogs, build up our inventory, and fulfill most of our US orders within 48 hours from the start of 2022,” Chief Commercial Officer Tal Brod said in an email.” (SupplyChainDive)

While a seemingly far-off concept for many distribution centers and warehouses, accessible options in the form of WMS and WCS integrations can collate data from various automation systems and present it in a way that suggests the best course of action. Implementing a platform like this now builds the foundation for machine learning later down the line and can provide an edge over the competition as an early adopter.

Supply and inventory resolutions and cleanup

With last year’s supply chain issues (especially at peak season), and all new ones that surfaced this year, many companies are re-evaluating their inventory management. One of the most prominent methods for retailers is strategically offloading unsold inventory during sales periods. Kohl’s has engaged in a “aggressive” campaign to cleanup product bloat by cancelling retail orders and marking down product prices substantially (SupplyChainDive). In the same vein, Best Buy proactively kept their inventory stock at nominal levels, boasting promotions throughout the year and diving into a new segment – device refurbishment.

For many distribution centers, inventory levels continue to be an issue. Either too much product is taking up precious space (largely due to consumers spending less as inflation rates soar) or there’s a deficit because of material restraints (for example: computer chips for the automotive industry).

For 2023, many companies have inventory levels on the docket as an action item to be managed more appropriately. The hope is that inflation will cool down, and specialized materials will become more available, but in the meantime, warehouses and DC’s will have to make do with their own resources. It’s a delicate balance to maintain and with a greatly fluctuating market, having the correct product quantity is key to running an efficient and lean distribution facility.