Background

The client is a packaging company that provides a multitude of services for a variety of industries that redefines supply chains with innovative tote handling to creative container design and e-commerce fulfillment; the client offers specialized supply chain solutions for any packaging operation.

Century Conveyor Systems was selected by the client to engineer a corrugate takeaway system for a co-packing plant in New Jersey after identifying areas of improvement in its facility.

Challenge

The client experienced increased co-packing demand and the number of empty cartons being produced created bottlenecks for the single overhead conveyor from the repacking tables.

Associates tossed cartons onto the belt instead of properly inducting, often missing the conveyor causing safety concerns or having boxes get jammed in tough-to-reach areas. In addition, 2 additional separate co-packing lines in adjacent rooms did not outfeed to the same bailer, requiring manual labor to consolidate all the separate corrugate.

Goals

- Streamline corrugate disposal process providing labor savings

- Optimize repacking times for quicker turnaround

- Connect disparate area lines and improve overall efficiency

System Specifications

- Engineering and Integration: Century Conveyor Systems

- Conveyor Equipment: Hytrol

- Software and Controls: Lafayette Engineering and Century Conveyor Systems

Integration

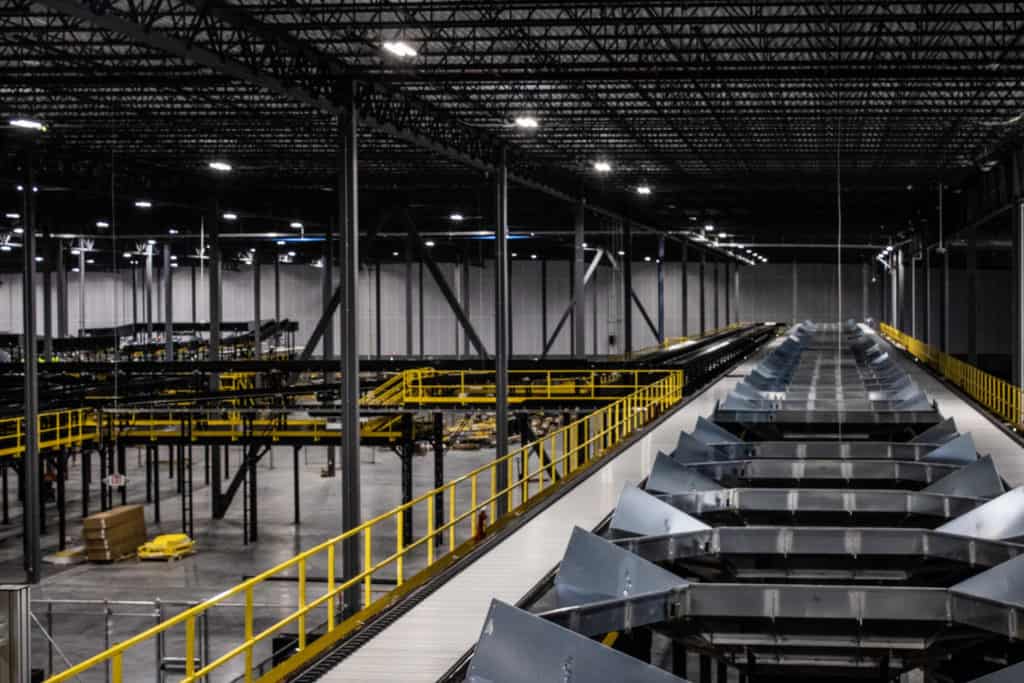

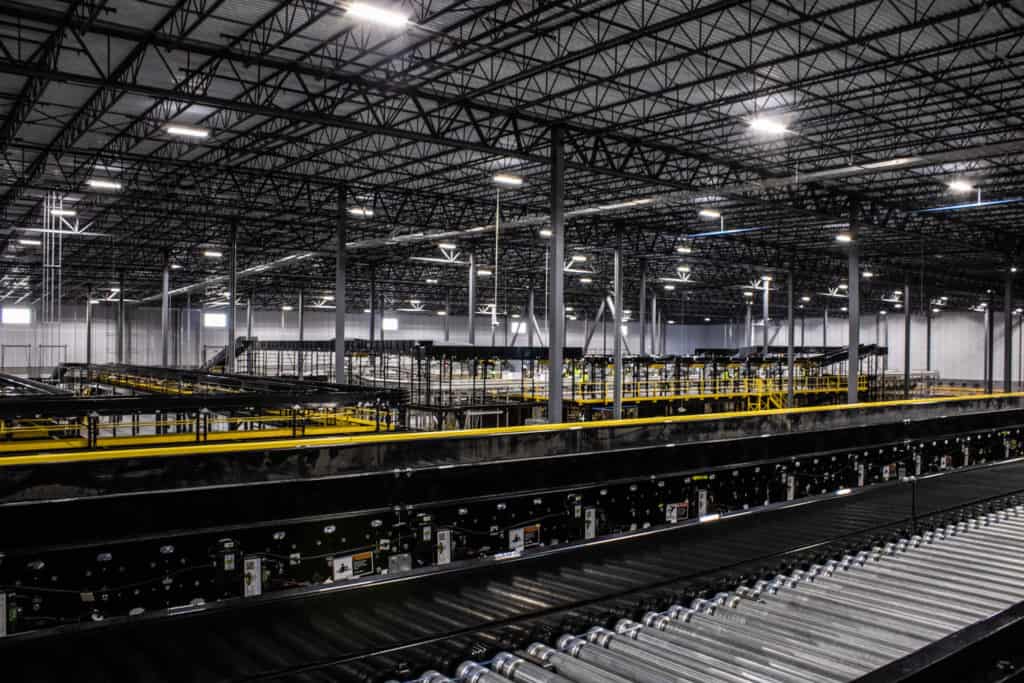

The conveyor system proposed by Century consisted of 16 portable Hytrol PC incline conveyors discharging onto 5 Hytrol TH takeaway conveyor sections. In-between each incline conveyor are pack stations with roller tables and operator terminals. Each operator receives a pallet and corresponding corrugate magazine to be erected and packed with product. Empty cartons are placed on incline belts that extend above to the overhead conveyor gently transitioning them onto the take-away conveyor.

In a constant operation like this, a durable and stable-FPM system is a must. Century knew this and designed the system using Hytrol TH sections rated to a constant flow of 65 FPM. Utilizing a belt meant that even small pieces of paper and cardboard could be disposed of using the conveyor system.

The 5 TH takeaway conveyors are connected in series with the prior conveyor water falling onto the next conveyor. At the discharge of the conveyor, the empty cartons elevate onto a final section before being dropped into a bailer/compactor.

Adjacent rooms have a similar system setup, but outfeed into the main facility floor by waterfalling onto the bailer line. Consolidating these lines avoided deploying multiple bailers and designing all sections overhead and through partitioning walls kept the warehouse floor clear for forklift movement and pallet storage.

Results

Enabling a combined single flow from all areas of the warehouse optimized packing operations, improved the efficiency, space utilization, and organization of the facility, and provided the blueprint for future co-packing areas in the warehouse.

“The system connected all our lines to feed into a single bailer, and the incline conveyors helped our staff efficiently dispose of boxes, decreasing co-packing times. The Hytrol equipment used has been incredibly reliable, and we’ve replicated the solution Century designed at other locations”, says the client’s Director of Engineering.

Even though the system is a relatively straightforward design, Century’s innovative engineering both made efficient use of facility space and enabled multiple co-packing lines to operate simultaneously.