With U.S. tariffs on Chinese imports reaching up to 145%, supply chain disruptions have once again taken center stage for American businesses. Rising costs, extended lead times, and increased uncertainty have prompted many companies to reevaluate their operations and seek sustainable solutions.

Across industries, firms are responding with bold investments in domestic infrastructure, automation upgrades, and new logistics strategies. Here’s how major players are adapting—and how you can too.

Logistics Industry Response to Tariffs: Movements by Key Players

Temu recently reversed planned price hikes by adopting a “local fulfillment model,” partnering with U.S.-based sellers to absorb tariff-related costs. This approach mirrors a broader trend: the desire to localize supply chains to preserve pricing power and delivery speed.

Kimberly-Clark is investing over $2 billion into U.S. operations, including an $800M facility in Ohio and a $200M automated distribution center in South Carolina. This expansion is projected to create over 900 jobs and reinforce their supply chain resilience through automation and innovation.

Roche is committing $50 billion over five years to expand drug and diagnostic manufacturing in the U.S., reducing dependence on imports and aligning with a national movement toward domestic production.

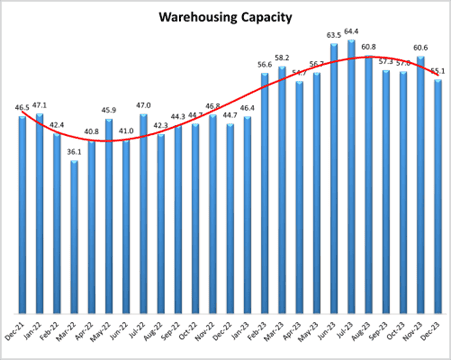

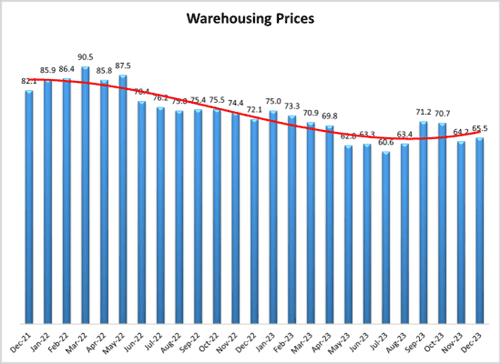

Prologis reports that customers are proactively increasing inventory levels to mitigate risks associated with potential tariffs. This strategy involves seeking additional warehouse space and short-term storage solutions, particularly through third-party logistics providers. Notably, some 3PLs have experienced a rise in space utilization from 83% to over 90%. The company has observed a 20% decline in its typical leasing activity, signing approximately 80 leases totaling over 6 million square feet in the past two weeks

Hershey, Amazon, Hasbro, and PVH Corp. are also actively reengineering operations:

Hershey launched a new 250,000 sq. ft. processing plant to enhance U.S. capacity.

Amazon is building a 930,000 sq. ft. cross-dock facility in Mississippi to streamline regional distribution.

Hasbro is cutting Chinese reliance to a single factory.

PVH is consolidating warehouse operations to boost efficiency by up to 90%.

Supply Chain Automation as a Tariff-Proofing Strategy

Rather than pause modernization efforts due to uncertainty, many companies are doubling down on automation—recognizing that it’s a hedge against both labor shortages and tariff turbulence.

Why Automation Now?

- Certain automation OEMs will soon raise prices if they rely on imported raw materials

- Companies that nearshore will require more labor; automation reduces workforce dependency

- In-house services limit exposure to tariff-influenced vendor pricing

- Uncertaintly prevails in this current market - but automation is a constant growth goal

- Customer buying behavior is expected to decline, consolidatation of capital and inventory may be in order

In a recent survey by C.H. Robinson, shippers said the top risk to their supply chains in 2025 is changes in tariffs and trade policy.

Nearly 50% said the uncertainty around tariffs and trade policy is a pain point for them today.

Survey results also show shippers are actively preparing for changes in tariffs and trade policy, including analyzing their existing customs data, identifying alternative suppliers, and re-evaluating their cross-border strategies.

Century’s Approach: Modular Automation for a Flexible Future

When optimizations are require to grow, but the cost of a complete overhaul is too big a bite to chew – phasing, retrofits, modernizations, and preventative maintenance are solutions Century often recommends to our clients.

In the current turmoil of trade policy, shifting supply chains, and not knowing what fees could be implemented in the future – it makes sense to minimize cost while gradually moving logistics in-house. This usually takes the form of automation, which can also be used to pivot to new product lines, services, or to take advantage of growing demand.

Century has had success integrating client systems with this method, since our focus is on maximizing your efficiency while maintaining cost-effectiveness and innovative engineering.

Best Use Cases:

- Proactively avoid rising costs related to current trade uncertainty

- Automate in a meaningful, yet budget-friendly project approach

- Remove inefficent operations and waste by identify areas that are prime candidates for automation

- Eliminate headaches and cost related to finding reliable warehouse staffing

- Move costly outsourced partners to an in-house model with automation

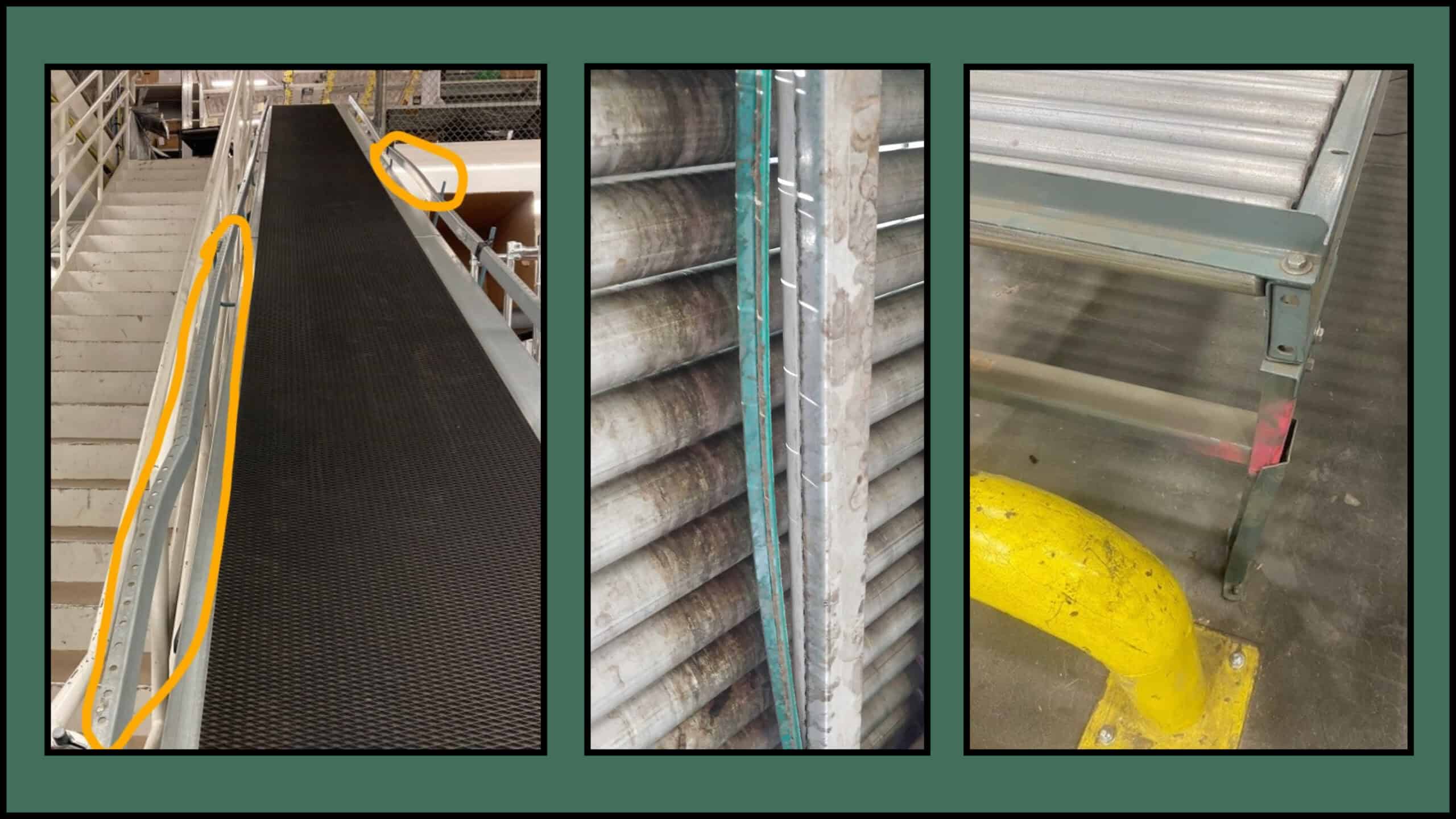

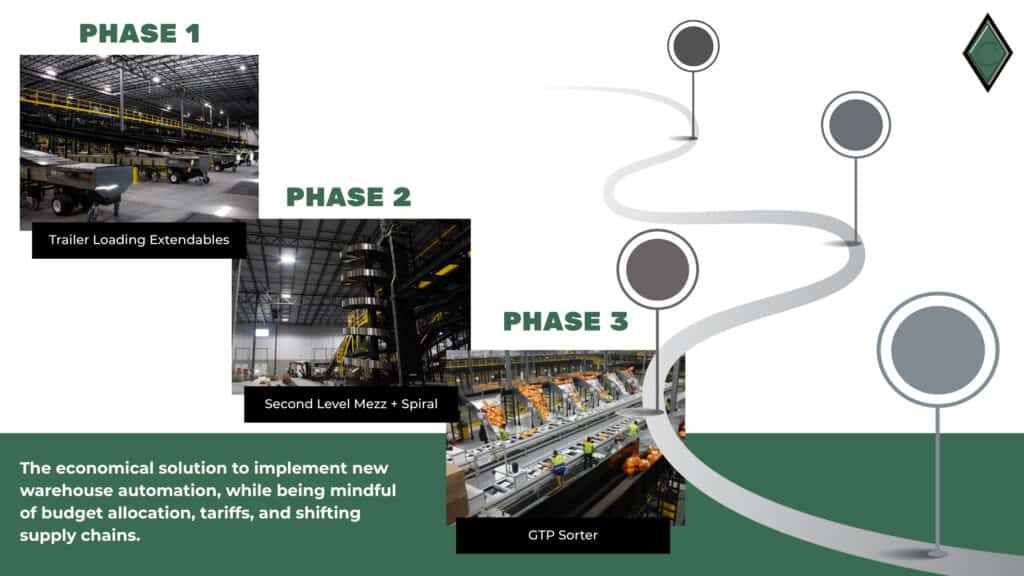

Phasing

Splitting a distribution facility project into phases that incrementally automate specific sections of your ops is a viable “two-birds-one-stone” solution.

When optimizations are require to grow, but the cost of a complete overhaul is too big a bite to chew – phasing the project into distinct segments that allow daily ops to be completed in tandem is a solution Century often recommends to our clients.

Benefits

- Budget minded - break a large capex project into cost-digestible phases

- This makes executive buy-in and allocations easier to acquire

- Implement new automation technology where it counts

- Open new lines, maximize space, eliminate manual ops, and grow business quicker

- A phased approach gives more time to train, test, and capture results for each new installation

Phasing may be the solution to getting your automation plans off the ground.

Retrofit

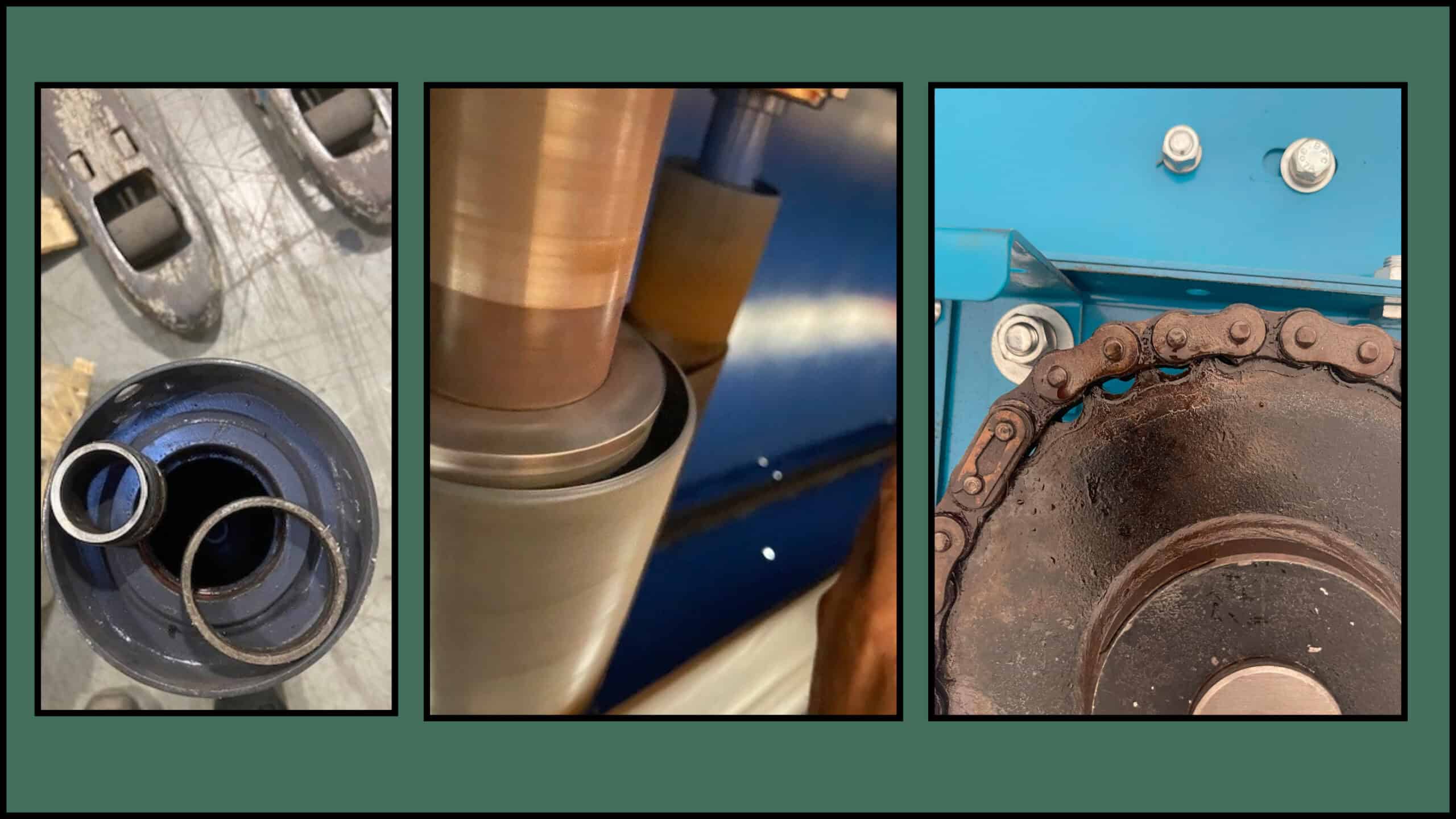

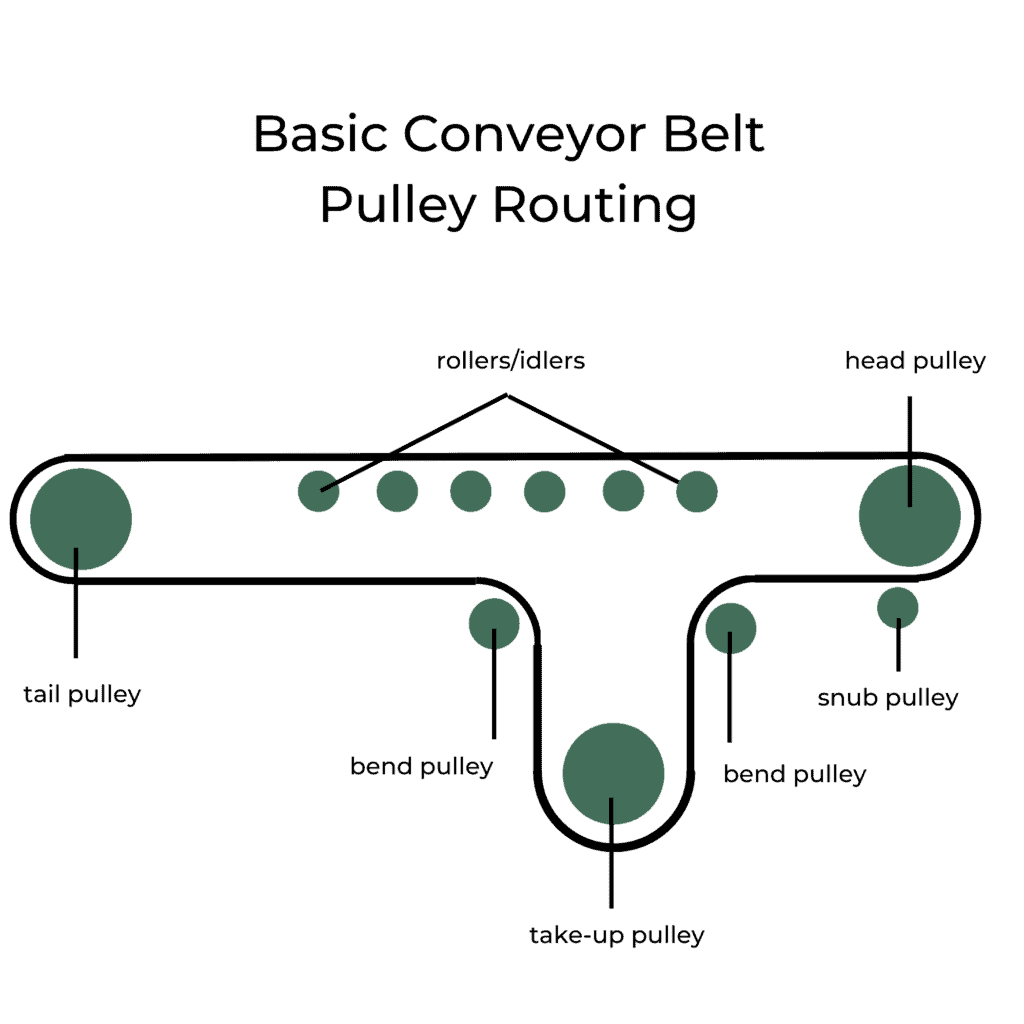

Unfortunately, conveyors don’t age as gracefully as a classic car or a vintage bottle of wine. Running equipment that exceeds 25 years of constant operation most likely means you’re not operating optimally.

Older conveyor systems come with the usual gamut of maintenance issues. Excessive downtime, hard-to-find parts, and a general decrease in mechanical functionality due to age and wear. But, the greatest negative of all is the lack of technology. Retrofitting modern and advanced equipment can inject new life into an operation.

Benefits

- Keep your system layout, simply remove and update the obsolete or worn equipment with new units

- Achieve higher order fulfillment and throughput rates

- Re-sell your old equipment

- Avoid failures and inefficiencies related to running old equipment

- Certain solutions - like a large sorter, can completely revolutionize operations

Retrofits are a future-proofing and cost-effective method to implement new automation tech.

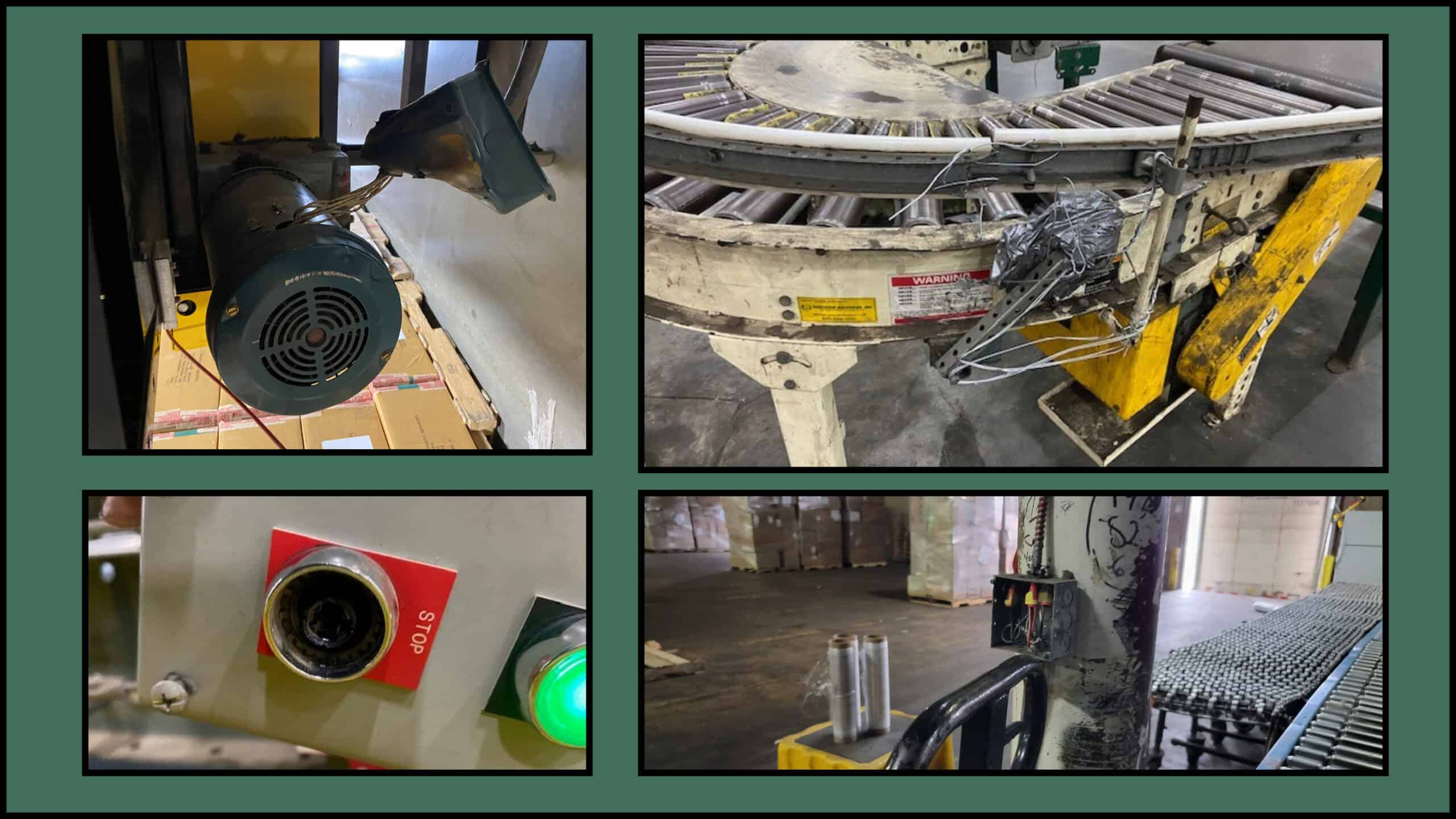

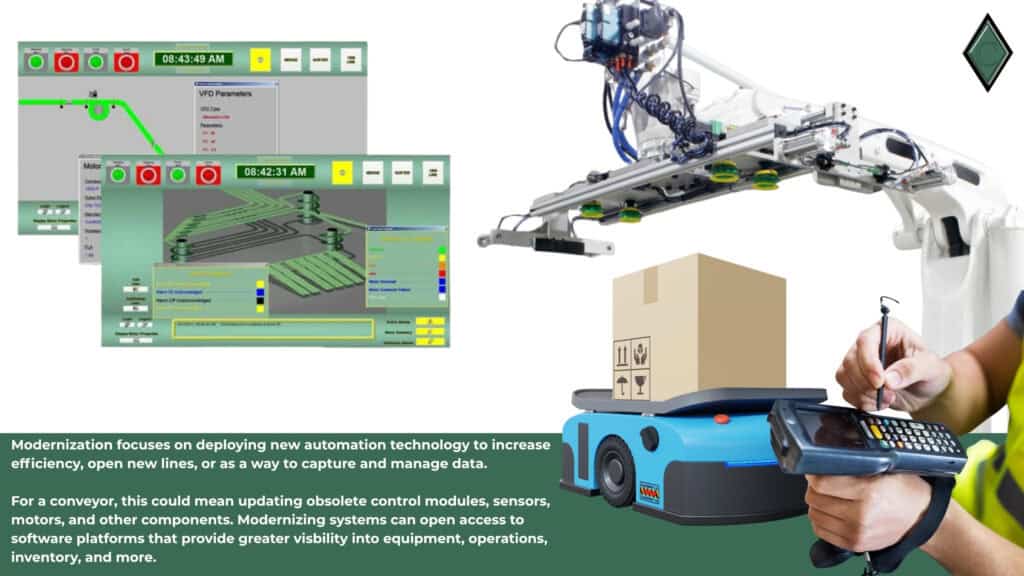

Modernization

If the equipment in your distribution facility are operating as expected, the key to squeezing every last drop of efficiency out of your system is proper modernization. The goal of this method is to update the ancillary components of your equipment.

Think photoeyes, scanners, sensors, controls, WMS, WCS, and other readily deployable systems. The mechanical foundation of your conveyors stay the same, but the information capturing parts are updated to modern standards.

Benefits:

- Upgrade to latest photoeye, sensor, and controls generation

- Gather valuable data and insights about your system to guide future decisions and investments

- Enable powerful WCS and WMS platforms for warehouse management, visibility, and inventory data

- Re-use your equipment - most cost effective option when compared to phasing and retrofits

Make the most of your current setup with proper modernization

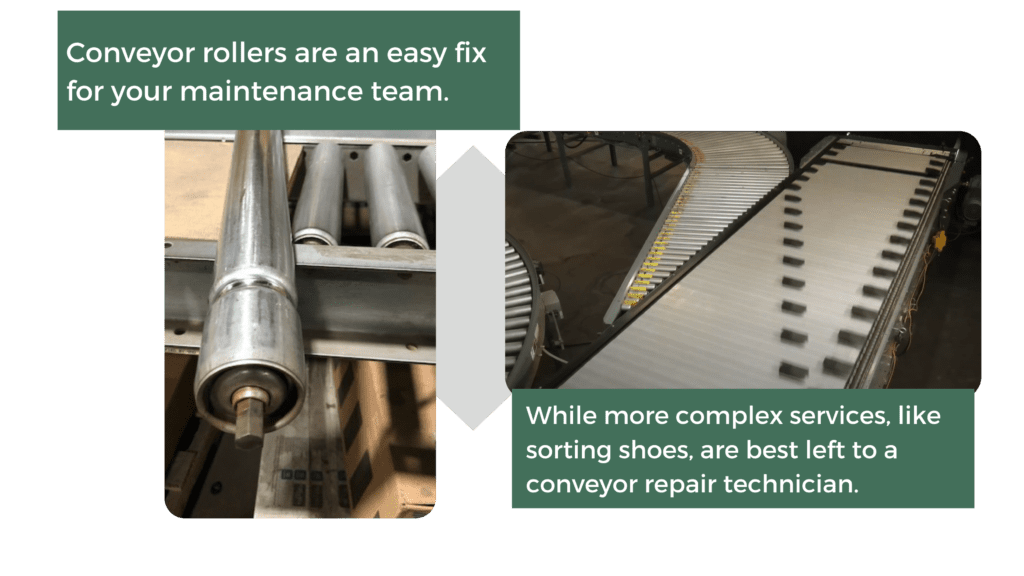

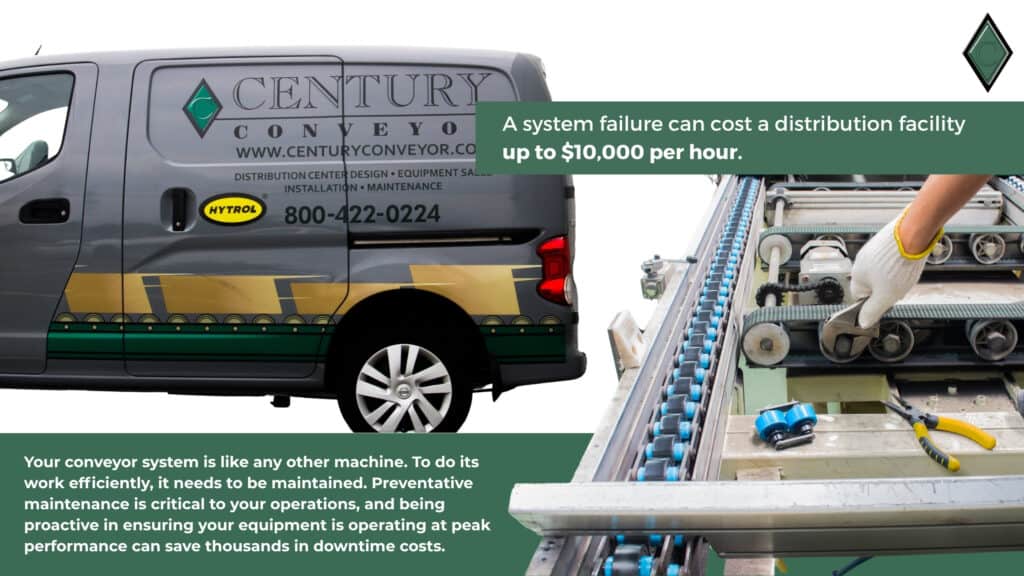

Preventative Maintenance

Downtime can destroy profits and leave operations halted until a conveyor tech can be dispatched on-site or a specific part is received. A Century PM contract offers routine servicing and part replacement on a frequency you decide. Having a PM in place brings peace-of-mind knowing your equipment won’t break down and is mechanically cared for on a regular basis.

Benefits:

- Avoid costly system failure situations and halted operations

- Extend the life of your conveyor system

- Peace of mind that your conveyors are always being routinely serviced

- Site visits can be custom built to your needs, and the same tech can service your equipment each time

- Catch when parts need to be replaced before they fail - allows time for component shipping

- Eliminate unsafe situations or band-aid solutions in your system

Century’s PM Program is flexible enough to meet your needs and budget.

Trade Policy

Certain policies and programs can help shippers, manufacturers, and distributors avoid tariff fees. While not applicable to all businesses – spending time evaluating your current supply chain with these trade options can save thousands if it’s approved.

Free Trade Zones (FTZ)

No duties on imported goods that are later re-exported

Delayed payment of duties on goods entering the US market

No duties on waste, scrap, or defective parts

More efficient supply chains

Inverted Tariff – gives companies the option of paying duty on a finished product or on the individual components—whichever is lower.

Special Trade Programs

Temporary Importation Under Bond (TIB): This program allows for duty-free importation of goods intended for export within a specified period.

American Goods Returned Declaration: This program allows some U.S.-origin goods to be returned to the country duty-free as long as there was no substantial transformation abroad.

Generalized System of Preferences (GSP): Under this program, certain products can be imported from designated beneficiary countries in the developing world duty-free.

Quick Summary

Future-proofing and enabling an adaptable and tech-focused supply chain is the best way to prepare for fluctuating trade policies. Understand the current landscape of your businesses’ industry and the impact of tariffs on the supply chain and adjust accordingly.

Streamlining and cutting the fat from your supply chain process by evaluating services and technology to transition to a more controllable internal model can avoid surcharges from 3rd-party suppliers.

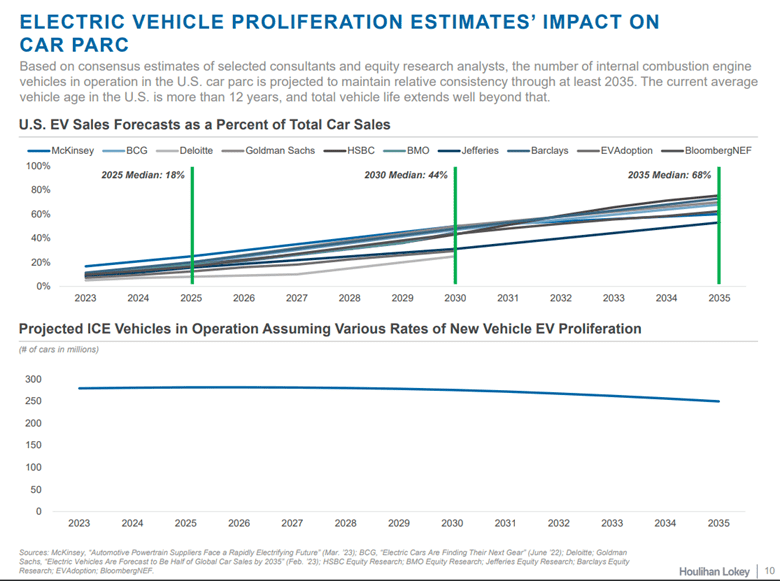

- Nearshoring and reshoring: Companies should evaluate the feasibility of moving production closer to end markets to reduce transportation costs and tariff exposure.

- Strategic partnerships: Companies should forge alliances with suppliers, logistics providers, and even competitors to share best practices and navigate tariff challenges collectively.

- Technology integration: Companies should invest in automation and artificial intelligence to optimize supply chain decisions in real-time and enhance visibility across the entire network. This can take the form of gradual modernization and retrofitting, or a phased system overhaul.

- System maintenance – Optimizing your automation equipment from a sweeping project standpoint may not be financially feasible, but retrofitting, modernization, and completing maintenance can offer a viable alternative.

Ready to future-proof your distribution operations?

Let Century help you plan, phase, and implement an automation strategy built for success —even in the face of tariffs.